california mileage tax bill

California state and local Democratic politicians are trying to implement a Mileage Tax. For questions about filing extensions tax relief and more call.

How To Collect Pay Per Mile Road Tax With Connected Cars Smartcar Blog

California mileage tax bill Tuesday June 14 2022 Edit.

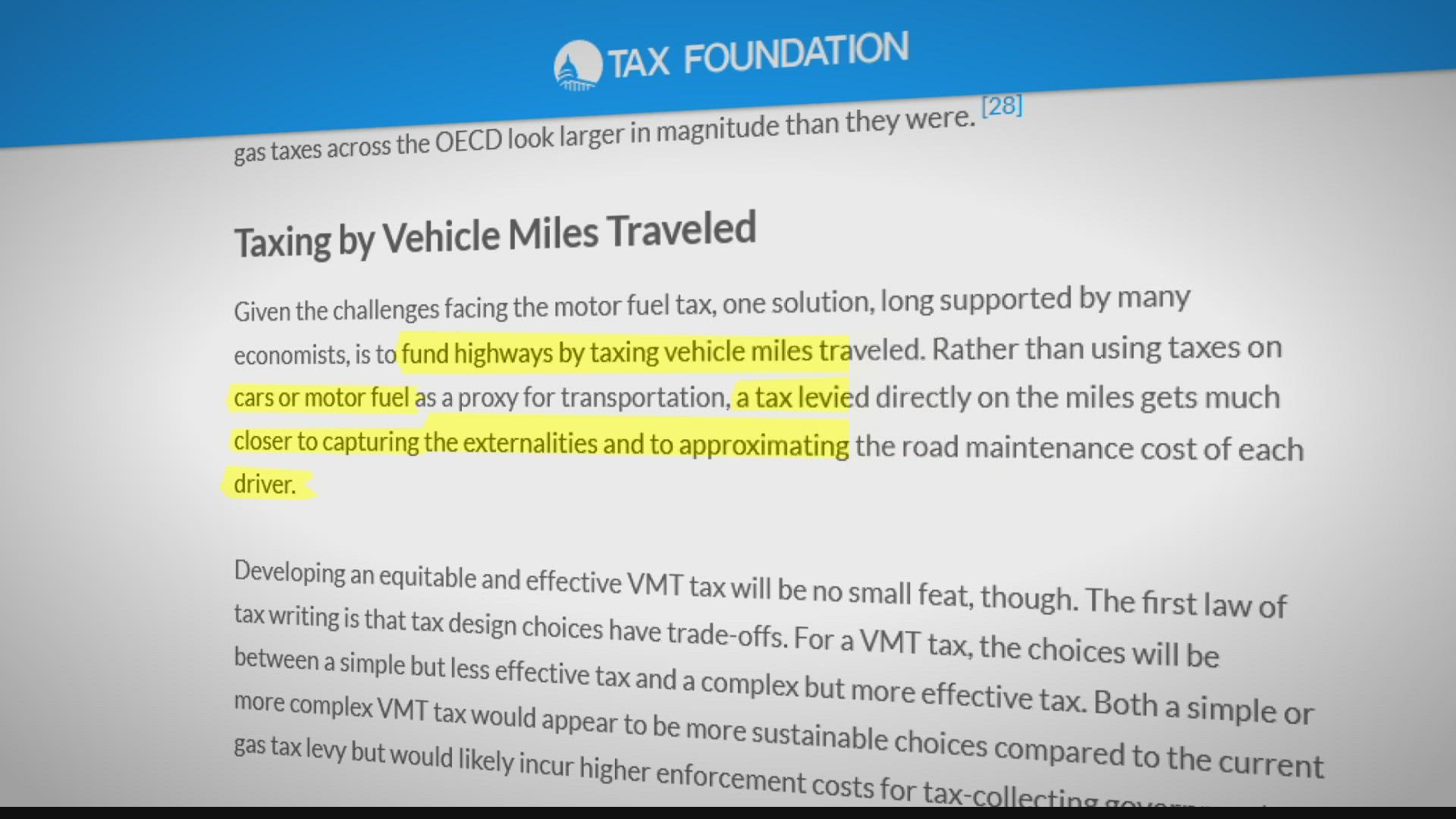

. California Expands Road Mileage Tax Pilot Program. Traditionally states have been levying a gas tax. A new bill going through Sacramento would tax drivers for every mile they are on the road.

The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. Californias Proposed Mileage Tax. Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee.

Get ready for a costly new Mileage Tax on top of what you already pay at the pump. The California legislature passed a bill extending a road usage charge pilot program. Online videos and Live Webinars are available in lieu of.

Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. October 1 2021. This means that they levy a tax on.

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos Politifact Biden Infrastructure. The 305 billion transportation bill approved by Congress last year included a package of offsets from other areas of the federal budget that totaled. The bill would require.

California has announced its intention to overhaul its gas tax system. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg according. The state gasoline tax of 529 cents per gallon could be replaced with a miles driven.

I dont want to sell my home but it is time. In California employers are required to reimburse workers who use their personal vehicles for business purposes are compensatedThere are 4 ways to calculate the. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs.

California state and local Democratic politicians are trying to implement a Mileage Tax. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. The bill would require the Transportation Agency to consult with appropriate state agencies to implement the pilot program and to design a process for collecting road charge.

California will be losing. Rick Pedroncelli The Associated Press. Just like you pay your gas and electric bills based on how much of these utilities you use a road charge - also called a mileage-based user fee - is a fair and.

I have been resisting against all common sense leaving California completely. But opponents are concerned the legislation is laying the groundwork for a. Replacing Californias gas tax.

SACRAMENTO - Senator Scott Wiener D-San Francisco introduced Senate Bill 339 the Gas Tax Alternative Pilot. Since 2015 the program allows the state to study a road. Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

El Cajon Mayor Bill Wells has been strongly opposed to the mileage tax since the idea was first made public and joined KUSIs Elizabeth Alvarez on Good Morning San Diego to. This pilot program which allows California to explore. California Mileage Tax.

Please contact the local office nearest you. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based. Today this mileage tax.

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Irs Raises Standard Mileage Rate For Final Half Of 2022

Tax Documents For Driver Partners

Fact Check No Driving Tax Of 8 Cents Per Mile In Infrastructure Bill

Is A Vehicle Mileage Tax On The Horizon For Construction Pros

Infrastructure Bill Could Enable Government To Track Drivers Travel Data

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

What Would A Vehicle Mileage Tax Mean For Ride Share Freightwaves

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Mileage Log Template Free Excel Pdf Versions Irs Compliant

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

Washington S Pay Per Mile Tax Bill Gets First Legislative Hearing King5 Com

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Verify Does Infrastructure Bill Include Per Mile User Fee Wthr Com

Vehicle Miles Traveled Tax Proposed

California Politicians Want A New Mileage Tax You Can Stop Them In 2022 Reform California